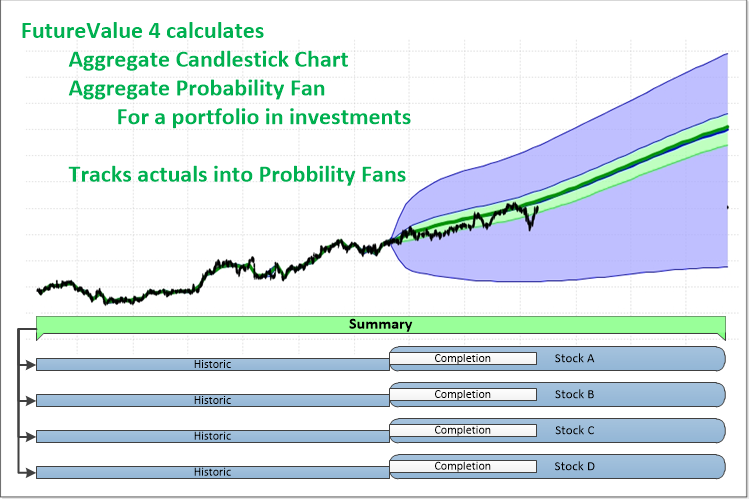

Model Investment Risk Visualize Portfolio Risk and Reward - Track Results against Expectations

How we're better

We're Easy to Use

We can solve systems containing thousands of independent sources of Risk - more than any other Patentedsystem.

Compared to any Monte-Carlo based risk analysis methods, we're

- Faster - orders of magnitude Faster

- More Accurate - We're numerically more accurate on every probability distribution

- Complexity - We can handle much more complexity.

We work with bounded asymetric probability distributions.

Think about it... on any investment, is your upside risk always equal

to your downside risk?

Yet, every time an analyst cites a mean and standard deviation - that's

what they are saying.

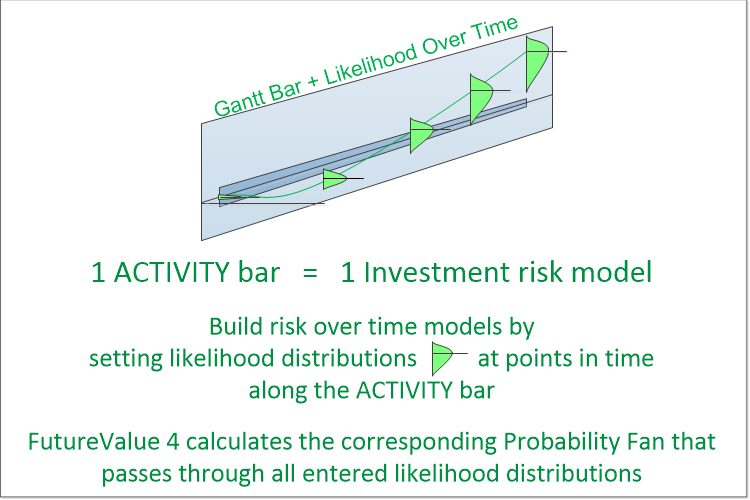

We work with probability distributions at points in time, and calculate over distributions - rather than aggregating single point solutons like Monte-Carlo based methods.

Investment Risk

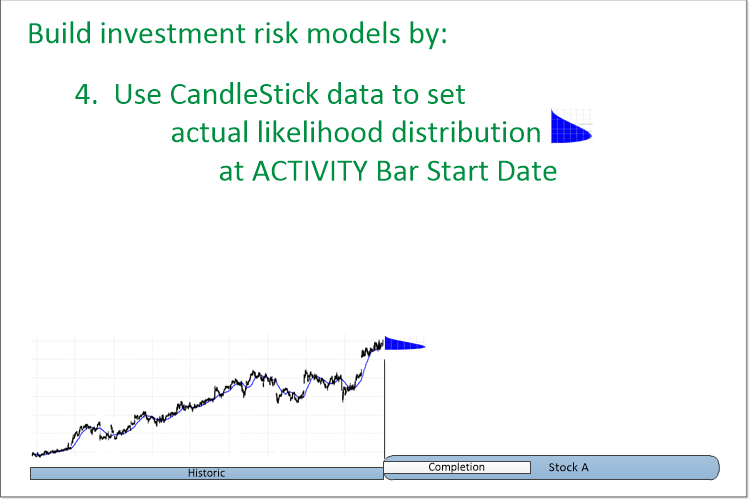

FutureValue 4 currently grabs Candlestick data off the internet (we could use your data sources as well, it's just what we do now), and allows you to generate likelihood models for individual investments.

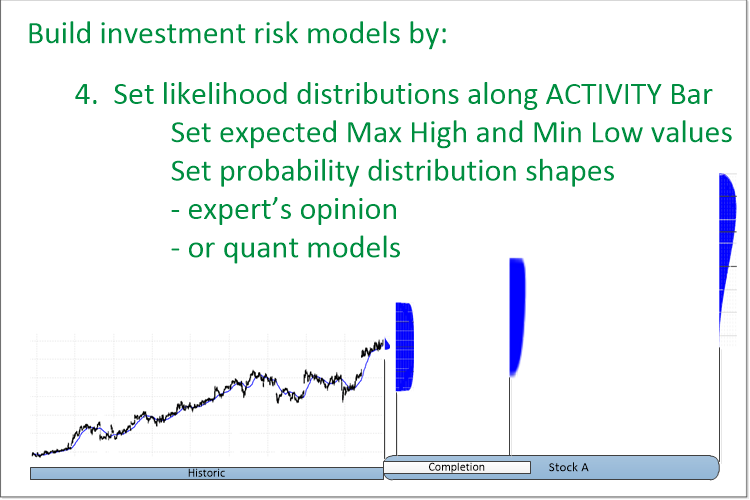

We think there are advantages to this. While simplistic, it allows Domain Experts to directly build models of unfettered likely future value. Then, Domain Experts can build other Bars in the heirarchy of Bars representing the portfolio - to represent other factors affecting value. For instance: Effects on value of currency exchange rates, competitive product releases, weather, congressional action, or whatever factors are thought important.

Every ACTIVITY Bar represents a decoupled Risk factor. If you want to change the model, change the Bar. If you want to remove the model from the analysis - just decouple it from it's Parent-Child attachment in the Gantt-like chart. Solving 400 Bars per minute -with linear scaling - means you can quickly look at many alternative analysis - not just many runs on one set of quant models with many variations in parameters.

We are capturing into Bars representing risk models - knowledge directly from Domain Experts. This allows us to easily capture ALL the knowledge the expert holds:

- Explicit knowledge: who, what, where, when, how much,… quantifiable statements.

- Tacit knowledge: WHY, beliefs, opinions,… non-quantifiable statements.

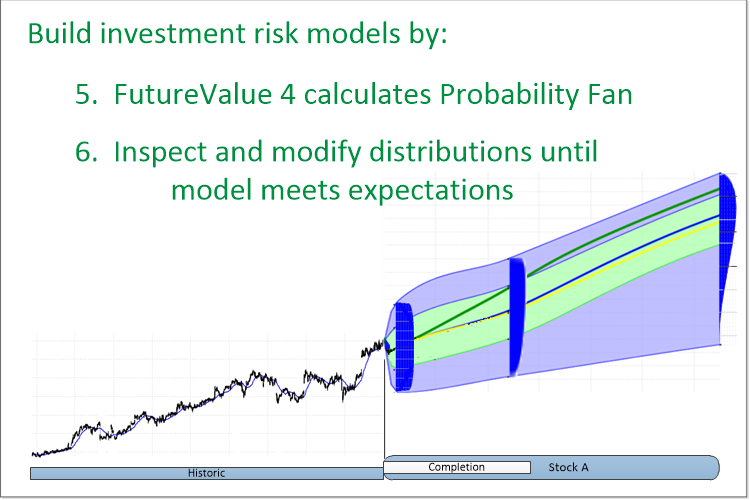

Then, using our (

Patented) methods, we generate aggregate

Probability Fans for 4 Stocks (green = 50% band) for

any number of combinations of your investments

and show you aggregate Candlestick charts including historic values and

current portfolio values plotting into the Probability Fans.

This is the simplest form of investment risk modeling we do. With each Bar representing a different risk factor, and the ability to handle thousands of independent risk factors - our methods are capable of handling much more complicated scenarios than any other time dependent risk analysis system - no other analysis system described in US Patents even comes close.

What about quant models

Rather use your quant models - we can use them too.

Financial modelling is about translating a set of hypotheses about the

behavior of markets or agents into numerical predictions.

See:

Building typical financial models entails genrating complicated numerical models - usualy by having programers (who know little about the problem) work with domain experts (who know little about programming) - working back and forth - validating - till they get a model for that aspect of the problem right. Then, they use a different numerical method to aggregate different models.

Although almost everybody does it this way, no one ever said you had to do it one point at a time ( Patents pending).

We take a different approach:

- Build your models about each aspect of the risk analysis independently.

- If they couple, run them together. If they do not, run them separately.

- Use the models to calculate probability distributions at points in time - for each model or coupled collection of models.

- Use our Patents pending methods to aggregate the model results.

IF you are currently using any Monte-Carlo based modeling - you are limited to less than 20 truly independent sources of risk.

Using our methods - depending on the server we're running on - we

should be able to aggregate thousands of your models quickly.

Speed changes everything.