Investment Risk Model a better way

Manage investment risk.

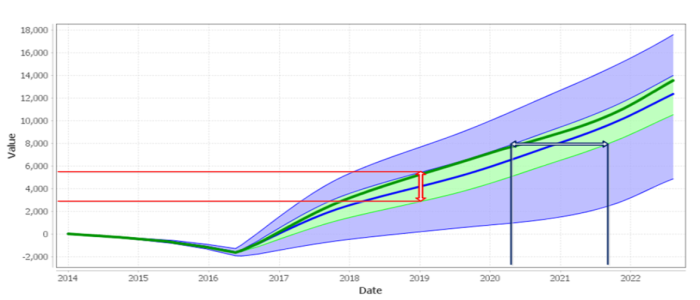

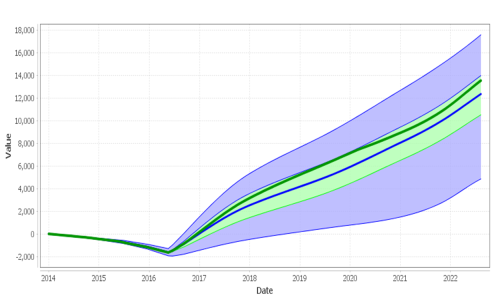

What performance do you expect from your portfolio?

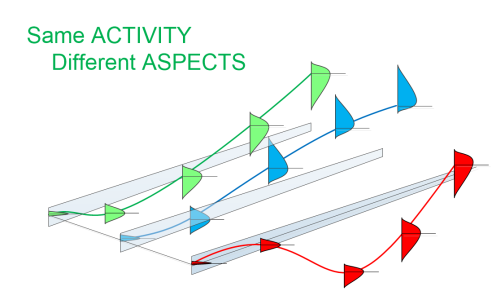

For each investment:

- What performance do you expect over time?

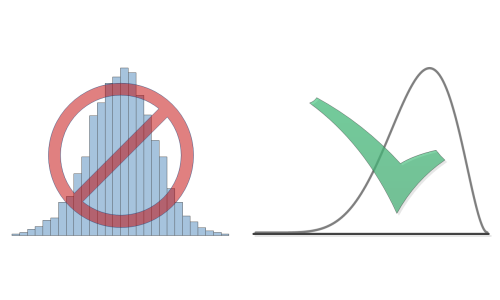

- What degree of volatility do you expect?

- How asymetric is the risk?

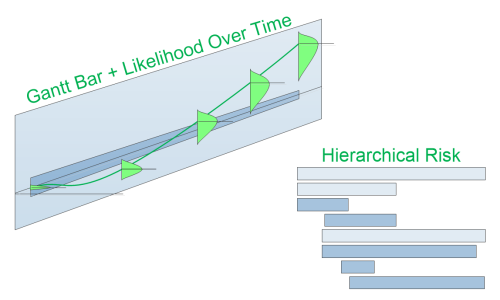

For your portfolio:

- How do those expectations add up?

- What levels of overall risk are you accepting?

Visualize Risk and Reward

We give you the tools.

- Set up a risk and expectations plan for each investment

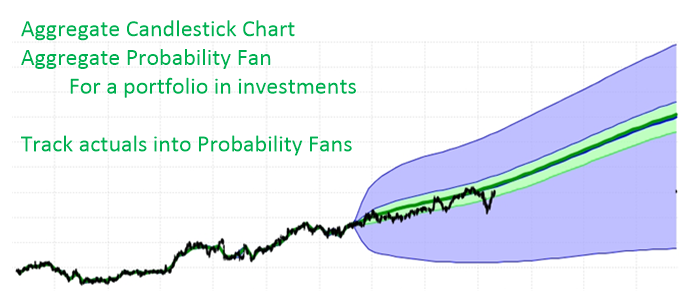

- Visualize aggregate risk and expected reward

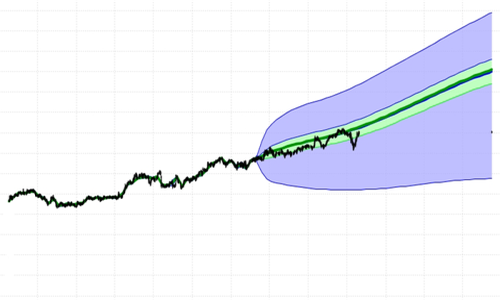

- Track actuals against plan

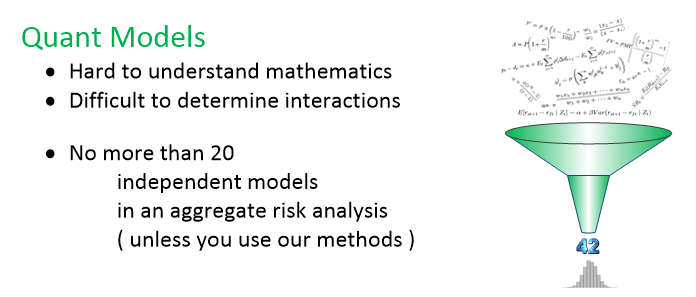

No programming - No Quant models - although, we can use them as well if you like.

If you plan exposure to risk and potential reward, and track how well you do against plan could you increase profits?

Learn MoreAggregate risk measurable.

We do this better than anyone.

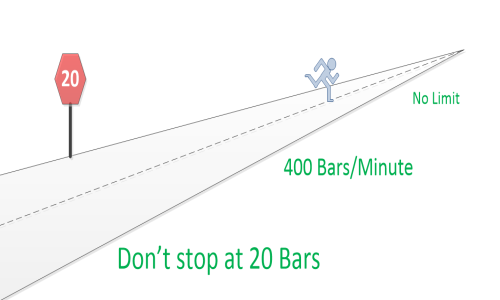

The trick is new ( Patents issued and pending) methods to calculate aggregate risk:

- Faster

- More accurate

- Able to handle more complexity - than anyone else

Measure and track - risk over time - at any and every level in your investment portfolio.

Gain

Insight - Increase Profits

Visualize Risk

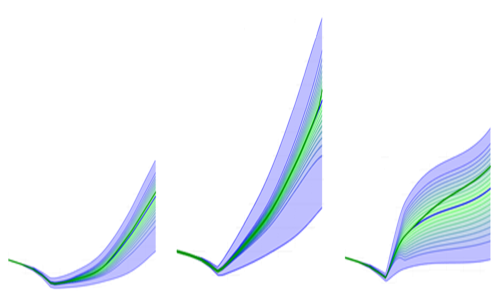

Probability Fans + Tracking + Drill-down + Annotations

Risk is visible using Probability Fans.

Deviations from plan during execution are obvious - using Tracking.

Drill-down lets you find sources of deviation.

Annotations can give you who, when, and why.

FutureValue 4 gives you a fairly complete set of tools to understand the sources of cost, risk, and reward in your portfolio.

Leverage your Quant Models

We can use them - we're just not fond of them.