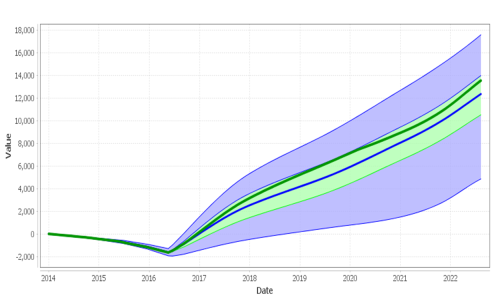

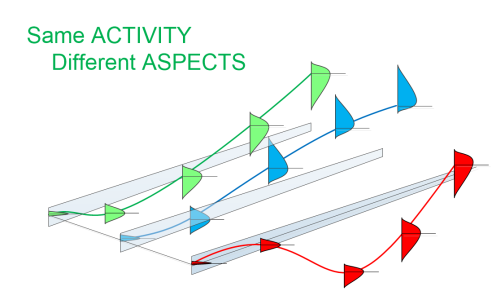

Communicate Sources of Risk and Reward - at every level

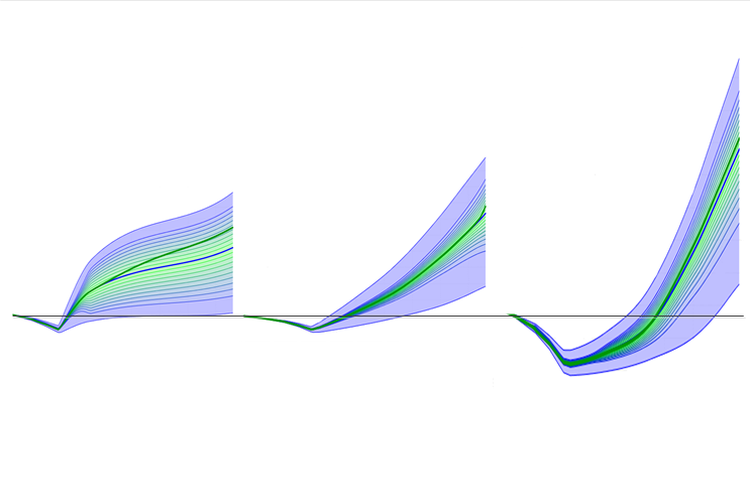

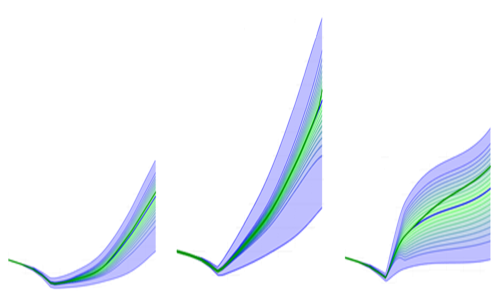

3 Scenarios - Visualize Risk

You have just been presented with 3 new product plans. The plans include Research, Development, Manufacturing Deployment, Marketing, Expected Sales, and Competitive Responses.

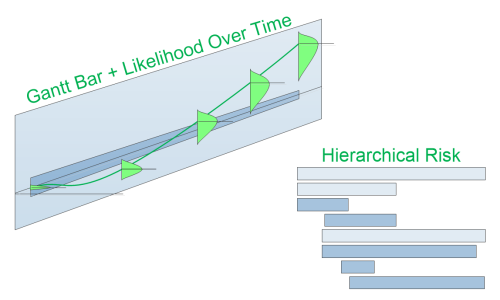

The aggregate Probability Fans for the 3 Scenarios are shown to the right.

Which would you choose?

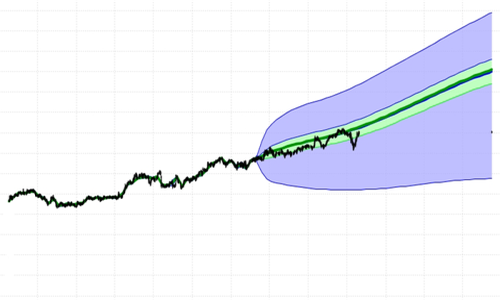

Keep in mind, Drill-Down can let you see the sources of risk and reward in you plans.

Annotations can let you see the underlying assumptions for each source of risk and reward in the plan.

Making changes to the plans - specifically to mitigate now visible risk - may let you find less risky plans with higher and faster rewards.

Consider: Scenario Planning , Analysis of Alternatives (AoA) , and weighted views of Alternative Futures. We support these methods and much more.

With risk in the plans visible, can you increase your profits?

Inspecting the graphs

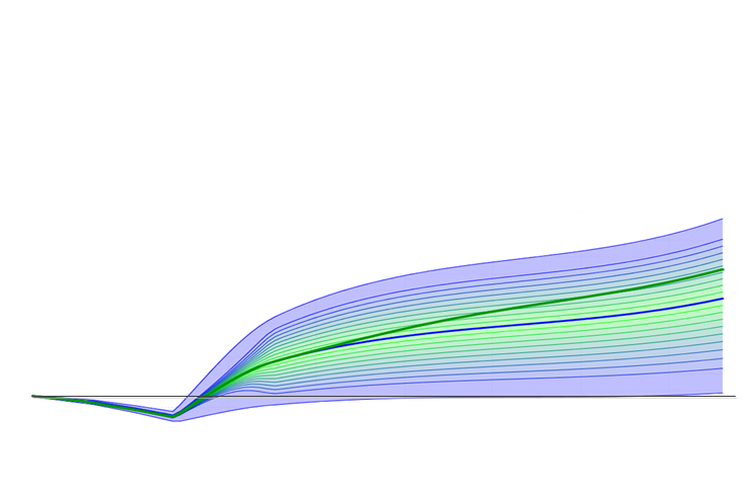

Scenario A

- Short runway - low risk - known costs

- Steep - low risk - takeoff

- Short and known time to expected return on initial planned investment

- Rate of growth quickly falls off - remains positive

- Risk spread is large in future

A product quickly introduced into a marketplace with fast - low risk development, willing customers, and fast following competitors potentially responding quickly with similar products.

Change the slope in later years. If you could hold off competitors, this product may be your best bet.

You may want to drill-down Drill-Down into the plan and find out the expected sources of the large spread in future risk.

Consider ALTERNATIVE plans specifically to decrease competitive pressure and mitigate risk: Effects of marketing campaigns, patent protection, etc.

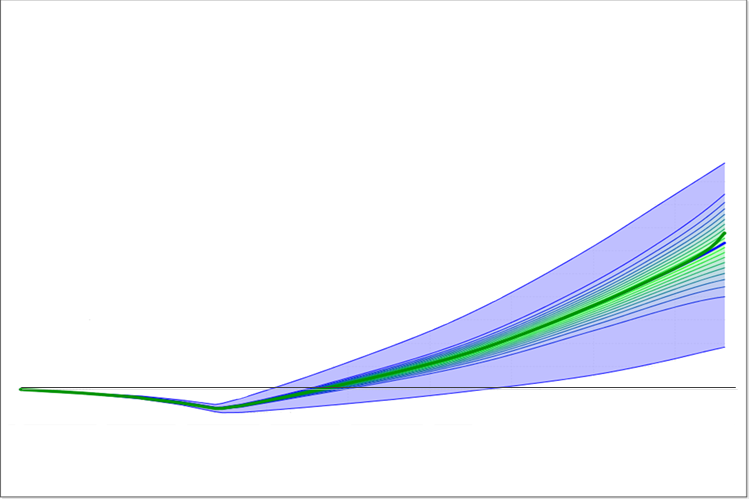

Scenario B

- Longer runway - low risk - known costs

- Shallow - moderate risk - takeoff

- Longer but known time to expected return on initial planned investment

- Rate of growth slowly but continuously increasing to roughly same level as Scenario A - but with less risk

- Risk spread increases slowly in the future

A product introduced into a marketplace with - low risk development, growing customer base, and slow following competitors.

Safe. Is this the best use of your resources?

Consider ALTERNATIVE plans specifically to increase market penetration: Effects of price and profit margin on likely sales, marketing efforts, expanding geographically, etc.

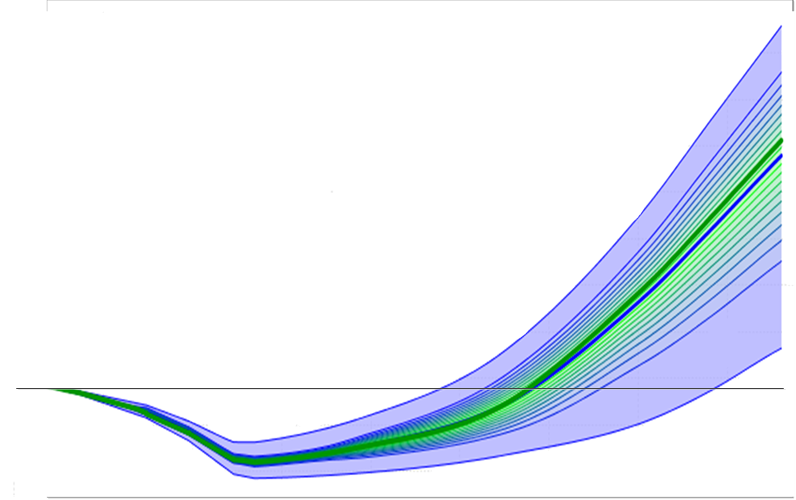

Scenario C

- Longer runway - high development/deployment costs - high risk - higher unknown costs

- Longer takeoff - with more risk

- Large spread in time till expected return on initial planned investment

- Rate of growth exponential to 150% of other two Scenarios in the same timeframe

- Risk spread increases slowly after break-even with high future growth

A product introduced into a marketplace with - high development costs, and mmore initial development, initial deployment, and initial marketing unknowns, but with higher future likelihood of profits.

Is it worth the time and risk?

Consider ALTERNATIVE plans specifically to decrease initial cost and risk and decrease time to market: How can you mitigate this front end loaded project? Would ALTERNATIVE research and development efforts result in decreased risk spread? Can you trade money for decreased risk and/or time?