Insight Understand risk in complex decisions

Insight is important

All investments entail risks.

Are statements like:

- "your mileage may vary"

- "diversification reduces risk"

- “past performance is no guarantee of future results”

really sufficient communications of the levels of risk you are about to accept?

How often are the sources of risk, and the amount of risk in an aggregate investment portfolio, or a business decision, presented, communicated, and understood?

When (not if) the plan changes, what new levels of risk and reward are expected?

Deming had it right: "You can't manage what you don't measure."

But, it's just a start.

The goal shouldn't be measurement and management, but understanding and

mastery - Insight.

Gain Insight

Insight - the capacity to gain an accurate and deep intuitive understanding - to be aware of the inner nature of things.

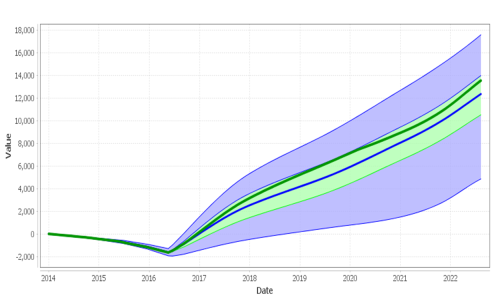

So - A first insight: The saying "The future is not just unknown, but unknowable" is false.

A more accurate statement is: The future is not predictable - in detail.

But likely future values are boundable.

I can say with high confidence that the Dow Jones Industrial Average will not hit zero tomorrow, and that it will not hit 100,000. The value tomorrow, will likely be somewhere in between.

History & Trends

History - If I look at past history, the DOW is very likely to not fall

below 15,000, and not exceed 50,000 tomorrow.

Trends - Looking at the past few weeks, and rate of change, I can narrow

the DOW's likely value further - with lower confidence.

Even with the disclaimer “past performance is no guarantee of future results”,

many investments are made on this bet:

IF - the environment in the future is like the environment in the past,

then past history and trends are indicators of likely future values.

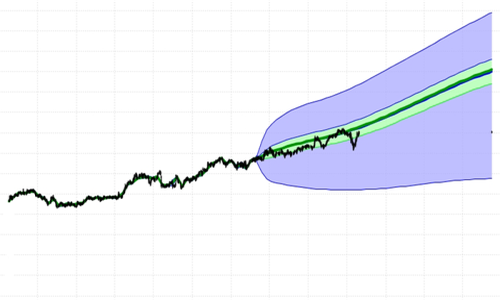

Tracking & Correction

IF reality deviates from the communicated and understood risk plan - the sooner that is known, the faster the corrective response, and the less the loss, or more the gain.

On the business side: Experts

An experienced manufacturing engineer can estimate - with likelihoods

- the time and cost to produce a manufacturing line similar to something

he or she has done before.

An experienced marketing person can estimate likely sales for a product

similar to but better than existing product.

The truth is, an experienced researcher can also estimate likelihood of

success and likely cost.

So, expertise exists. Likelihoods can be estimated.

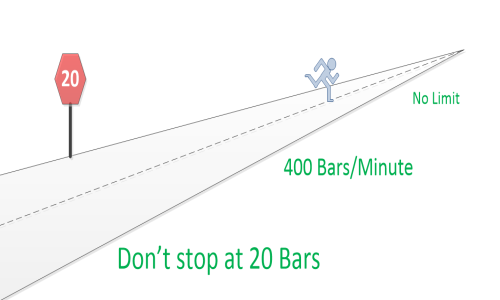

The problem was - prior to our software - no tool existed that could aggregate

these many sources of risk.

We can.

FutureValue

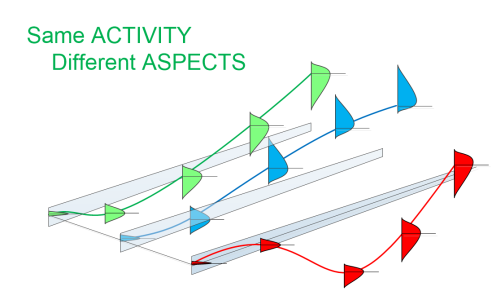

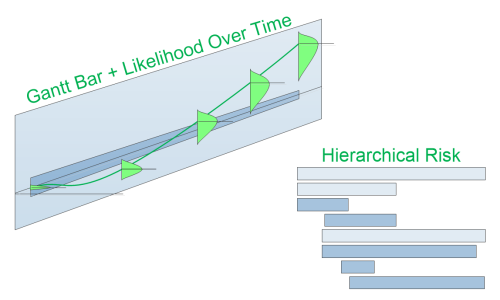

FutureValue has a

Gantt-like view of interconnectivity,

Tracking ,

Drill-Down , and

Annotations - this gives you a new and fairly complete set of tools to

Visualize ,

Communicate , and

Manage risk and reward over time.

New tools to understand risk in complex decisions, and Gain Insight.

Insights Gained

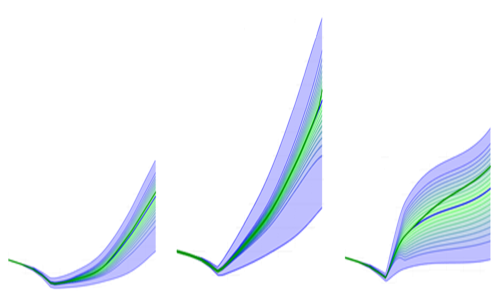

Using FutureValue itself has led to some interesting Insights:

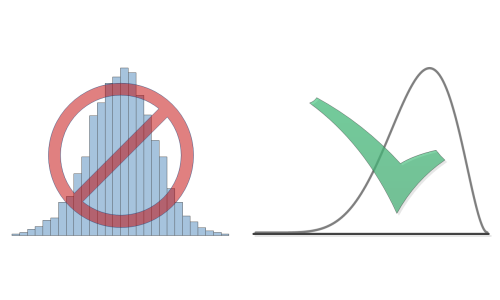

- Without Visualization - Insight is lost in Complexity & Mathematics

- Without Drill-down - or other ability to disect a risk analysis and determine sources of pain or gain - risk values may be known, but corrective actions are hard to discern.

- Real world Likelihoods tend to be a lot more asymetric than statisticians would have you believe.

- I suspect that the reason many risk analysis systems fail - is that they can't handle enough different sources of variability. We can.